The Louse in the House: teaching financial principles to your kids

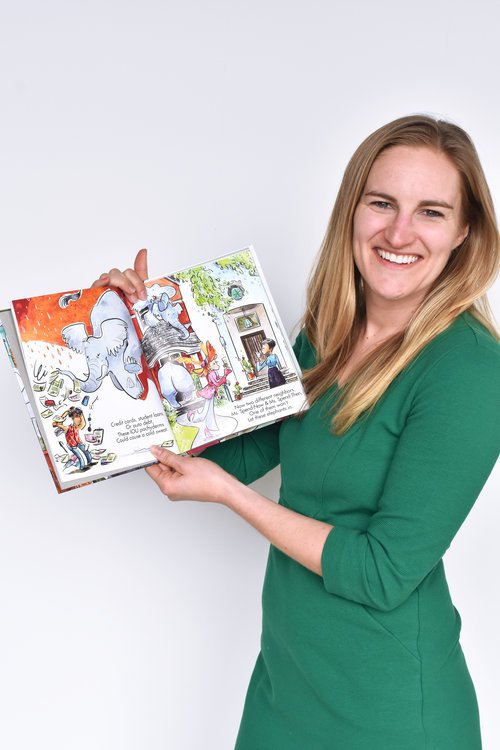

I’m so excited to announce that I’ve published my very children’s first book, The Louse in the House.

The Louse in the House tells the story of Ms. Spend-Then and Ms. Spend-Now in a beautiful illustrated, light-hearted manner that helps kids of all ages understand basic financial principles like debt and why, ideally, it’s something to avoid.

It’s a wonderful tool, particularly for Financial Advisors and Trust & Estate Lawyers because, as you hand out the books to your clients’ for their children and grandchildren, it provides an easy segue for you to have an educational conversation with them.

You’ll recognize Ms. Spend-Now as the person you know (or possibly even you) who has debt, and plenty of it. She’s not a bad person, not in the least! She simply doesn’t understand the potential long-term negative impact carrying debt can have…at least in the beginning of the book. As the illustrations show, Ms. Spend-Now buys and buys and ends up with a huge elephant (debt) in her home.

Her neighbor, Ms. Spend-Then, as you might imagine, saves her hard-earned dollars and carefully chooses her purchases. She befriends Ms. Spend-Now and helps her understand how she can get that elephant OUT.

WHY DID I WRITE IT?

As you may know from other posts, when my siblings and I were growing up, we attended “Dad’s Class” every Saturday. We learned about a variety of financial topics, at a basic level. Sometimes they didn’t make sense at the time but, later, those lessons came full circle. As I grew up and entered the business world, I realized how far ahead I was than my contemporaries in understanding financial principles.

Not everyone is lucky enough to have a Dad’s Class to attend as a kid and, as a result, many successful people have never fully grasped the concepts my father tried to teach us along the way.

I decided that I wanted to share those concepts with kids of all ages, as my father did with us, by breaking them down into bite-sized tangible ideas. The class was my dad’s style, writing the children’s book is mine.

WHY A CHILDREN’S BOOK?

Financial concepts are complex, but even kids can gain rudimentary understanding when they’re explained simply. The Louse in the House (which is the first in a series) tackles debt, without even naming it! Instead, I use the image of an elephant, because they suck up all the money and continue to grow and bloat. It’s also something people don’t like to talk about, so it has the secondary imagery of being the elephant in the room.

I’m passionate about helping people understanding these concepts, and I wanted to break down a really complicated subject so that even a child could understand it. If they can, then any person, at any age, in any income bracket, can grasp the concept, too. When that happens, I’ve done my job.

TALKING POINTS

At the end of The Louse in the House, I included a list of Talking Points, so the reader—of any age—can discuss the ideas with someone who has solid knowledge of financial principles, whether that’s their parent, grandparent, financial advisor, or attorney.

If you’re giving this book to clients to share with their children or grandchildren (or giving it to the younger generation in your own family), the Talking Points at the end provide an easy start for a conversation about debt, for you to ask them questions, for them to ask you questions, and for you to provide insight. In addition to the other services you provide, The Louse in the House helps you provide added value by educating your clients as well as their families.

HOW DO I ORDER COPIES?

The Louse in the House and the other upcoming books in the series are available to order for your employees and/or clients. Contact us today to find out more.

Millennial Guru thrives on helping businesses empower, transform, and motivate their teams and believe that a healthy financial life helps everyone live life more fully. Schedule a no-commitment informational meeting today to learn more about how Millennial Guru can make a difference for you, your team, and your clients.